About Fossil Fuel Subsidies in Canada

It's been more than 10 years since Canada pledged to end fossil fuel subsidies - and yet public financial supports for the oil and gas industry keep rising. Learn more about Canada's record on fossil fuel subsidies and why eliminating these harmful policies is key to addressing the climate crisis

What are fossil fuel subsidies and financial supports?

The only internationally-agreed definition of “subsidy”, from the World Trade Organization (WTO), is: a financial contribution by a government, or agent of a government, which confers a benefit on its recipient in comparison to other market participants. However, there is still a lot of debate and disagreement about what falls under this definition, and not all governments, including the government of Canada, use it consistently.

Examples of federal subsidies include: direct spending through government programs, for example on research and development, and tax breaks like flow-through shares, which incentivize oil, gas, and mining exploration and result in foregone revenue.

To complicate matters, G20 countries introduced the concept of “inefficient” fossil fuel subsidies. Unfortunately, there exists no standardized definition for efficiency versus inefficient subsidies.

The definition given by Canada was criticized by the Auditor General for being incomplete and failing to take into account the environmental or social costs of subsidies. We argue that alignment with our climate commitments should in fact be the most important criteria for whether a subsidy is deemed to be efficient or not, so that any measures that are not aligned with these commitments are considered inefficient.

Support is a broader term, but the most common form is public financing. Public finance can take the form of grants, loans, equity, bonds insurance, guarantees, and technical assistance provided by the government or a government agency to a private company. When a government lends or provides insurance, it assumes the risk associated with that project - risk that other lenders might refuse. This gives substantial commercial and competitive advantage to domestic fossil fuel producers.

This debate over definitions, though important, misses the point that governments are using a range of tools to provide support for fossil fuels. By looking at the broad scope, we can get a better sense of whether governments are gearing their full support towards decarbonising their countries’ energy systems in order to avoid dangerous temperature rises, as they have promised to do.

Why are there such different numbers for subsidies and supports?

Despite an existing international definition for subsidies, there is still a lot of disagreement about what constitutes a subsidy or not. Governments and organisations make assessments using their own approach, which leads to different numbers.

In addition, focusing solely on subsidies misses a lot of the financial support being provided by government and government agencies, for example through public finance.

This is why some assessments, such as ours, use a broader lens that captures both subsidies and supports. Some organisations, such as the International Monetary Fund, include externalities such as the healthcare costs of burning fossil fuels in their inventories.

The lack of transparency and public reporting from governments also makes quantifying total subsidies and supports very difficult, which also can result in different numbers.

How much federal support was provided to oil and gas companies in 2020?

Quantifying yearly financial support provided to the oil and gas sector by the Government of Canada and its agencies remains a difficult task. Federal tax deductions are not disclosed. There is no comprehensive inventory of direct spending by the government.

From what we do know, the government announced a minimum of almost $18 billion to the oil and gas sector in 2020. This includes $3.28 billion in direct spending and $13.6 billion in public financing, primarily through crown corporation Export Development Canada. Our report Paying Polluters: Federal Financial Support to Oil and Gas in 2020 documents everything we could find. Given the lack of information on tax breaks, this number is an underestimation.

This doesn’t include externalities like the healthcare costs from the impacts of fossil fuels or the cost of pollution clean up. For example, according to the Canadian Medical Association, the burning of fossil fuels is responsible for $53.5 billion in health-related costs each year in Canada.

Is financial support to oil and gas to reduce their emissions considered a subsidy?

Yes! Minister Wilkinson often repeats that government spending that has environmental benefits is not a subsidy. But ultimately, this transfer of public funds to private corporations helps fossil fuel companies lower their cost of business, so they are correctly classified as subsidies by the WTO.

When environmental outcomes are attached to subsidies, subsidies often fail to achieve their stated objectives. And there is no process for reviewing these subsidies or for determining whether they are the most effective or affordable way of achieving an environmental outcome. For example, the government could instead create regulations that require companies to meet environmental standards, and penalize them for failure to comply.

Why are fossil fuel subsidies bad?

Subsidies are a common public policy tool that governments employ to support a specific economic sector or to achieve a desired social outcome. There are numerous circumstances that justify the use of subsidies. For example: a subsidy might ensure a social good is produced and fairly distributed to all, like education. Or it could support new and emerging sectors that are in line with government priorities, like renewable energy. In this case, the subsidy corrects against the fact that impacts of pollution are not fairly accounted for by the market and it helps new industries find a foothold against the current technology.

Subsidies and public financing to oil and gas companies:

- Harm our health: Governments are propping up an industry that is killing us. A recent report found that one in five premature deaths is caused by air pollution from burning fossil fuels. In Canada, that’s 36,000 people a year.

- Contribute to climate change: Government support for fossil fuels is incompatible with keeping global warming below 1.5ºC. By making it cheaper to find, extract, process, transport and export fossil fuels, subsidies encourage more fossil fuel production, increasing the risk of locking in greenhouse gas emissions for decades to come.

- Divert resources from public goods to private hands: Public financial support for fossil fuels redirects vital government resources away from other priorities that benefit all of us, such as healthcare, clean energy and just transition.

- Yield very little in terms of job creation. Fossil fuel industries create fewer jobs per unit of output than any other sector in the Canadian economy. Compared to funding for fossil fuels, clean stimulus creates nearly three times as many jobs for equivalent investments.

- Distort the energy market: Subsidies distort markets, favouring oil and gas over renewable energy. In doing so, they increase the market failure caused by underpricing pollution and climate impacts.

Has the government promised action on fossil fuel subsidies?

Yes! In 2009, Canada and other G7 and G20 countries, first committed to phasing out inefficient fossil fuel subsidies by 2025. In addition, under the Paris Agreement, all governments have committed to “making finance flows consistent with a pathway toward low greenhouse gas emissions and climate-resilient development”.

Since making these commitments, Canada has reformed only a handful of tax measures. As part of its G20 commitment, Canada committed to undergoing a G20 peer review of fossil fuel subsidies with Argentina in June 2018. Through this process, Canada is evaluating “inefficient” federal fossil fuel subsidies. However, the review is significantly behind schedule - other reviews took between 12-18 months - and there has been little transparency on what measures it will include.

Generally though, the Government of Canada has no roadmap or plan to eliminate its current supports, and keeps introducing new ones.

Given the negative impact of subsidies, why do they exist and why hasn’t the government made more progress in eliminating them?

The persistence of subsidies demonstrates the influence of the oil and gas industry. The oil and gas lobby has pushed hard for subsidies to remain hidden. They even continue to contend that the sector isn’t subsidized - even while lobbying for increased subsidies. This is an industry with incredible access to the government.

Over the course of the COVID-19 pandemic, oil and gas companies and industry associations have been meeting with government officials close to 5 times per day. In fact, oil and gas companies took advantage of the COVID-19 pandemic to lobby for new subsidies - and the government agreed. For example, in April, the Canadian Association of Petroleum Producers asked for increased access to credit delivered through Export Development Canada and funding to reduce environmental liabilities. Both of these requests were granted.

We see the government use the confusing definitions issue to wash their hands of having to do real work. And the lack of transparency makes pushing for reform quite difficult.

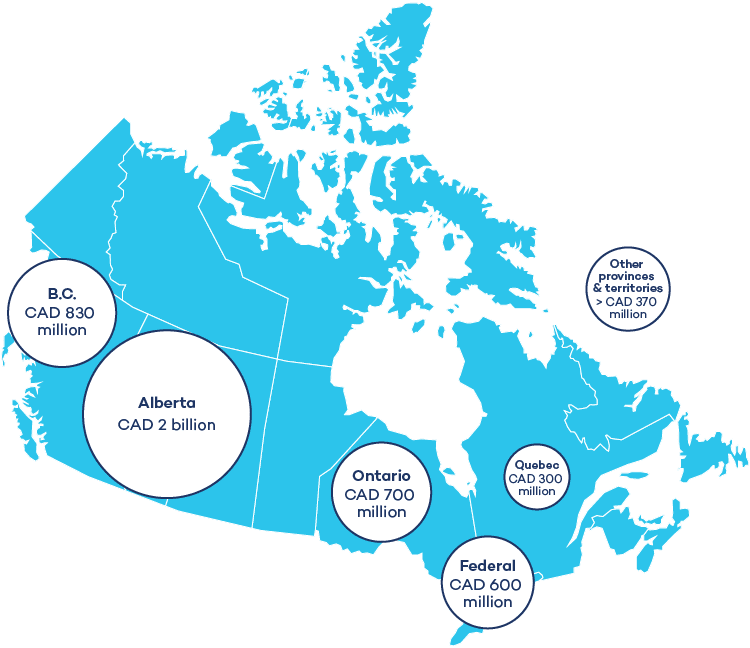

Do provinces give fossil fuel subsidies?

Provincial governments are also major providers of financial support to the oil and gas sector. Like the federal government, provincial governments haven’t transparently reported how much they really provide in fossil fuel subsidies and financial support.

Examples of provincial subsidies include crown royalty reductions in Alberta valued at an average of CAD 1.16 billion and deep drilling and infrastructure credits in British Columbia valued at CAD 350 million in 2019. (Check out our report section for more details!)

Will eliminating fossil fuel subsidies hurt workers?

Fossil fuel subsidy reform can be done in a way that supports job creation, setting Canada up to thrive in a low-carbon economy. Careful government spending can support worker transitions from fossil fuels to clean energy while encouraging a shift away from the production and consumption of fossil fuels.

At least 53,000 jobs in the Canadian oil and gas industry have been lost since 2014 and the industry is no longer a stable source of job creation, pointing to an urgent need to support workers through just transition and economic diversification, for which subsidies hold us back.

Sometimes job creation is used as an excuse to create new subsidies - but then the intended jobs never materialize. We know fossil fuel industries create fewer jobs per unit of output than any other sector in the Canadian economy.

Have other governments taken action on subsidies and public financing? How does Canada compare?

Canada provides the second highest levels of public finance to oil and gas of all G20 countries - and the most on a per capita basis. On a recent scorecard, Canada ranked last among OECD countries on progress in ending support to fossil fuels.

Momentum to end public finance of fossil fuels among Canada’s peers and major trade partners is snowballing. The US, EU, and UK have all taken steps towards phasing out international public finance for fossil fuels. The United Kingdom has already announced it will no longer provide public finance to overseas fossil fuel projects.

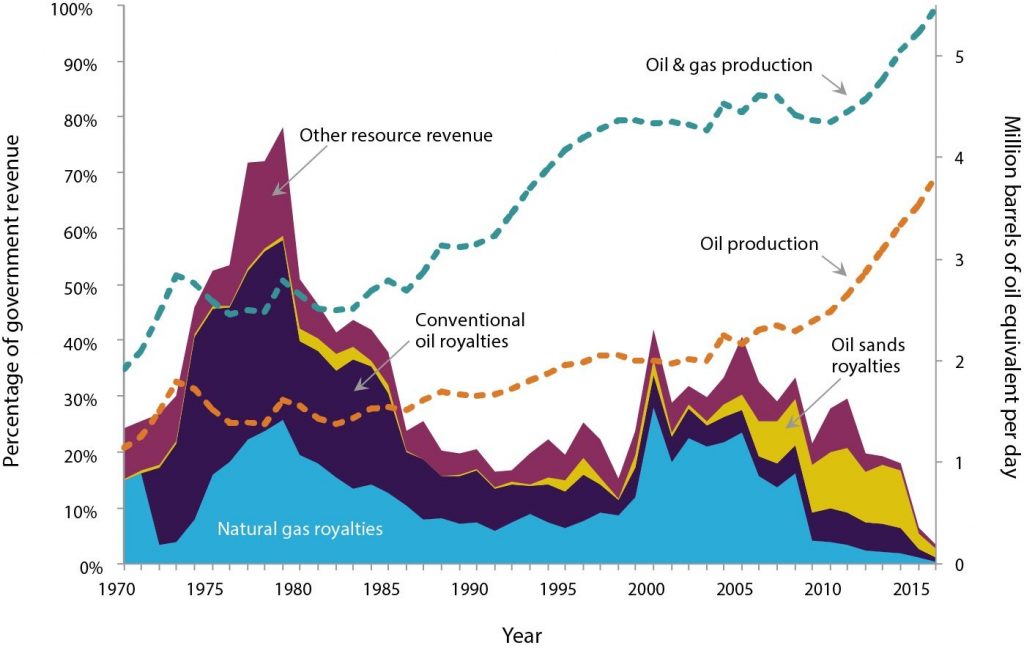

Aren’t subsidies far outpaced by royalties and revenue from oil and gas?

More than 30 years ago, many Canadian governments earned substantial income from oil and gas production primarily through royalties or taxes, but that is no longer the case.

Royalty revenue from hydrocarbon production has plummeted 63 per cent since 2000, and corporate taxes earned by government on drilling and refining activity have declined more than 50 per cent - despite national oil production growth of 75 per cent. That trend is continuing.

Analysis from 2017 showed that companies that year generated $53.5 billion in revenues and $10 billion in profits. When you total up the royalties and taxes paid to the various levels of government by those same companies, it was just $3.21 billion. That is far less than what the companies received between provincial and federal subsidies and supports.

What should Canada be doing?

- Demonstrate transparency by releasing information on quantified amounts of all federal fossil fuel subsidies, public finance and support on an annual basis.

- Develop and publish a roadmap to achieve Canada’s commitment to phase out inefficient fossil fuel subsidies before 2025, and shift these investments and public finance towards supporting a path to resilient, equitable zero-carbon societies.

- Ensure that all future government spending aligns with our climate goals by attaching strict conditions and principles to government programs including by ensuring that programs uphold the polluter pays principle.

- Phase out all domestic and overseas public finance for fossil fuels, including finance provided by Export Development Canada.

- Work with the provinces and territories to address fossil fuel subsidies at the sub-national level.