How Canada’s Proposed Supply Regulation Will Make Electric Cars More Affordable

When people talk about electric vehicles (EVs), it is often taken as a given that they are inherently more expensive than gasoline cars, while the promise of price-parity is elusively always right around the corner.

But this idea that EVs are inherently a luxury product is often exploited by the gas car lobby. For example, a recent National Post opinion column uses this idea to falsely claim that a Clean Car Standard, (which aims to phase out the sale of new gasoline cars by 2035) will increase the cost of living.

But EVs don’t have to be luxury vehicles. In fact, EVs are already cheaper than gasoline cars… just not in North America. To understand the reasons why, we need to dive a little deeper into the North American car market and unpack why it is the way it is. Understanding this will make you realize that requiring automakers to shift away from gas cars will actually reduce EV prices and improve the cost of living.

TAKE ACTION: Tell Canada you support a strong Clean Car Standard to shift to electric vehicles

Dude, Where’s My Affordable EV?

It’s in China. Chinese car companies like ‘Build Your Dreams’ (BYD) recently wowed people at the Shanghai auto show when they unveiled the Seagull, with a starting price of roughly $14,000 CAD and a range of 305 kilometres on a single charge. Vehicle electrification is happening differently in China – with the fastest growing segment being small, cheap electric cars for budget-conscious buyers. They’ve done this through strategies like ‘vertical integration’ to better control costs. BYD for example, makes its own batteries and semiconductors, which has helped it directly innovate with battery chemistry and obtain a cost advantage.

In North America and Europe, EVs have entered the car market from the ‘top-down’ rather than the ‘bottom-up’ like in China, by first focusing on the luxury segment, because that is where the profit margins are highest. For car companies that mainly sell gas cars, the luxury car segment is the only one that makes sense if you are producing EVs in small numbers. That’s because making EVs at low production volumes is typically done at factories with mixed assembly lines for both gas and electric cars, which are wildly cost inefficient compared to EV-dedicated setups intended for high-production volumes.

It’s not like North American car companies don’t know how to make affordable electric vehicles. In fact, Chinese car companies learned how to make cars in-part from western car manufacturers. To sell in China, foreign automakers have for a long time had to set up joint-ventures with Chinese car companies, as part of a deliberate effort to transfer technological know-how. In fact, one of the best selling EVs in China, the Wuling Hongguang Mini, is priced at just over $6,000 CAD and built by General Motors (GM) in partnership with a Chinese state-owned firm, SAIC Motor.

Automakers Have Cornered the Protected North American Market With Expensive, Polluting Cars

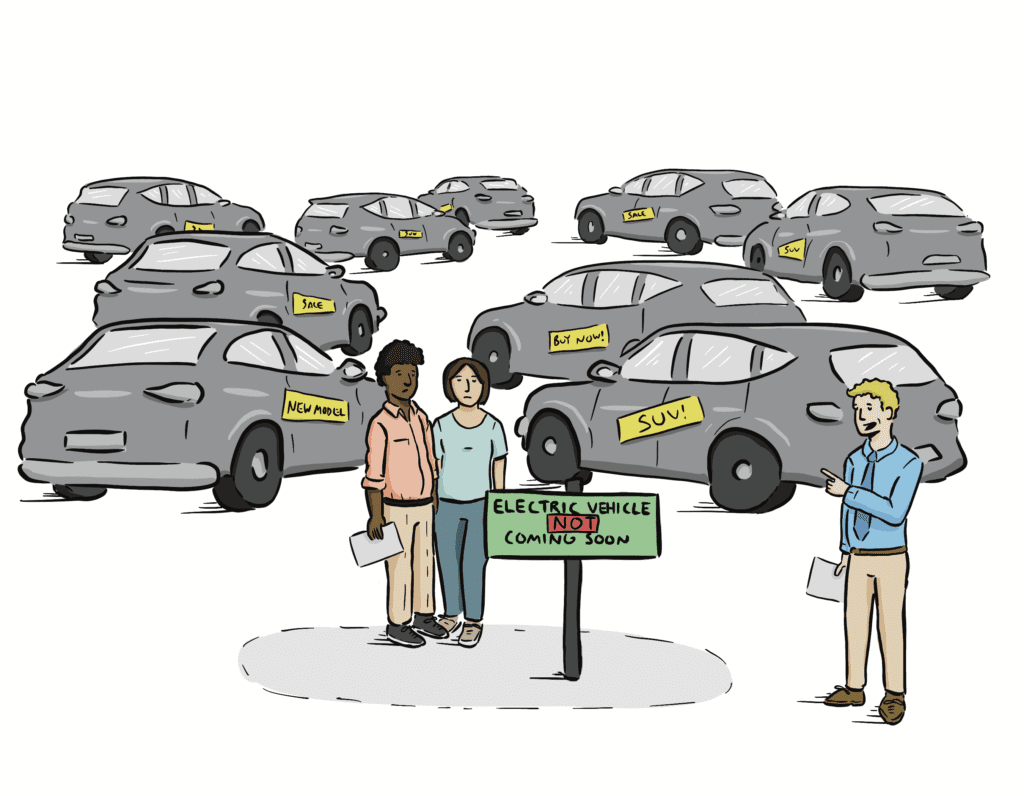

The reality is, we don’t have affordable EVs in North America because the gas car companies make more profit from selling expensive gas SUVs and pickup trucks, and they’d like to keep it that way. From 2010 to 2019 the share of SUVs and pickup trucks as a percentage of all new car sales in Canada has steadily climbed from 55% to 75%. As these more expensive vehicles have taken over the market, it has pushed up overall average vehicle prices.

This takeover is partially because domestic pickup trucks and SUVs don’t have to compete with international models, thanks to a 25% US import tariff. With the Canadian auto market so tied to the US, this tariff affects what is on offer here too.

This takeover is partially because domestic pickup trucks and SUVs don’t have to compete with international models, thanks to a 25% US import tariff. With the Canadian auto market so tied to the US, this tariff affects what is on offer here too.

But the bigger issue is what we call the ‘bigger car loophole’ in North American tailpipe emissions standards. In effect, SUVs and pickup trucks (‘light trucks’) have much less stringent tailpipe emissions standards in Canada and the US than more compact sedans have. This has allowed car companies to evade actually cutting tailpipe emissions from their fleets by selling fewer compact cars that face the stronger standard and instead selling more SUVs and pickup trucks that face the weaker standard. This is a problem, because if SUVs were a country, they’d rank sixth for greenhouse gas emissions in the world, just behind Japan.

How the Pandemic Turbocharged Auto Prices and Automaker Profits

More recently, this problem has gotten significantly worse, with car prices exploding since the pandemic. The average selling price of a new vehicle in Canada is now $45,500, which is more than 30 per cent higher than it was in 2019. To explain why, economists have used the term ‘seller’s inflation’ to describe what happened in the auto market since the pandemic to push prices – and profits – to record highs.

In effect, pandemic lockdowns created a supply shortage of a key input material for cars: semiconductors, a kind of computer chip. This was hugely impactful for car prices. If all competing firms in a market all lack the same key input material at once, those firms get temporary monopoly-pricing power that they can use to expand profit margins by hiking prices above their initial increase in costs. This is because nobody can gain access to more of the materials in short supply (such as semiconductors) to undercut their competitors, so no firm is constrained by traditional competitive pressures and potential losses in market share as a result of price hikes.

So that’s what automakers did – they expanded their profit margins by building on the same trend they’d been working at for years. They put their limited computer chip supply in their most profitable – and least climate friendly – models (SUVs and pickup trucks), at the expense of fuel efficient compact sedans and electric vehicles.

Putting Price Over Volume

As car companies doubled down on using the pandemic to widen profit margins, EV production got kicked to the curb, and buyers were put on waiting lists with wait times up to three years long. As is inherently the case when producing at low volumes, the limited supply of EVs that did come out were high-priced, luxury models.

As this ‘price over volume’ shift happened across the auto industry – the supply of new cars declined while prices and car company profits exploded. This is supported by Statistics Canada data. In 2022 the number of new vehicles sold in Canada was 21% lower than it was in 2019, but car company sales revenues were only 6% lower, indicating a shift towards the sale of fewer, but more expensive cars. In the early months of 2023, the share of gas guzzling SUVs and pickup trucks have now hit a record 86% of all new car sales, up from 75% in 2019.

The used car market, where people with lower-incomes tend to shop more, has been hit hard too. Fewer new cars coming to the market has slowed turnover and caused used car prices to shoot up. This has led to significantly increased profits at car dealerships, and some have even been reported to be engaging in unethical price gouging behaviour.

The used car market, where people with lower-incomes tend to shop more, has been hit hard too. Fewer new cars coming to the market has slowed turnover and caused used car prices to shoot up. This has led to significantly increased profits at car dealerships, and some have even been reported to be engaging in unethical price gouging behaviour.

Now, the semiconductor supply shortage is essentially over according to many industry analysts. However, car prices aren’t falling. Why? Because the auto industry has fallen in love with their inflationary profits. In fact some industry analysts already note that automakers are hoarding chips, about 10-20% more than they need to meet demand.

What’s the solution?

There is one solution – and that is zero-emission vehicle (ZEV) supply regulation, otherwise known as a Clean Car Standard. How does this work? It’s a requirement for a gradually rising share of an automaker’s total fleet sales to be zero-emission. Currently, the federal Government’s target is to reach 100% of all new vehicles sold to be zero-emission in 2035, in line with targets set up by regulators in California, British Columbia, Quebec and the European Union.

The important part is how car companies react to this kind of regulation. In effect, their inflationary ‘price over volume’ strategy stops working. Car companies won’t be able to base their business plans around shifting their product mix towards selling high-polluting, expensive cars anymore. That’s because they’ll have to comply with meeting climate targets instead of only considering what’s best for their bottom lines.

The important part is how car companies react to this kind of regulation. In effect, their inflationary ‘price over volume’ strategy stops working. Car companies won’t be able to base their business plans around shifting their product mix towards selling high-polluting, expensive cars anymore. That’s because they’ll have to comply with meeting climate targets instead of only considering what’s best for their bottom lines.

In this situation, the only way for a car company to expand their profit margins is to invest in cutting production costs and to take market share from their competitors by supplying a more attractive product to consumers at a better price. This is exactly what is predicted by economic modelling done by the Sustainable Transportation Action Research Team (START) at Simon Fraser University. This modelling found that enforcing EV sales targets in Canada with supply regulation would make automakers more than double research and development (R&D) investments in cutting costs and bring more affordable EV models to market, resulting in prices for the median EV falling by more than 20 per cent.

Automakers must be shocked out of complacency

It’s clear that automakers are highly resistant to doing this, because they’d like to keep things exactly as they are right now. North American car manufacturers have become lazy and complacent, and too happy to simply enjoy the huge profits from dominating the SUV and pickup truck market behind high tariff walls instead of investing and innovating. The only thing that will shock them out of their stupor is a regulatory market signal telling them to wake up and start making the affordable EVs of the future.