This is the second in our series of blogs about how governments are bailing out the oil and gas sector during the COVID-19 crisis. Read the first in our series, about why it’s a bad idea to pin Canada’s recovery on oil and gas, here.

What’s the link between Canada’s export credit agency, Export Development Canada, the COVID-19 pandemic and the climate crisis?

In a nutshell, Export Development Canada (EDC) – a crown corporation – has been funnelling over ten billion dollars a year in financial support to the oil and gas sector. This is despite Canada’s long standing commitment to phase out fossil fuel subsidies. And now, the federal government has tapped EDC as the agency of choice for a significant portion of its pandemic response plan, including a bailout of oil and gas companies.

(Side note: export credit agencies are public entities that provide corporations with financial support through government-backed loans, guarantees, and insurance to support exports and foreign investments. They can make financing available to companies that the private sector won’t touch – like the Trans Mountain and Coastal GasLink pipelines.)

The COVID-19 pandemic demands swift and unprecedented action from the federal government. But what we don’t need is to exacerbate the climate crisis. How governments respond to COVID-19 and its economic fallout could either protect us from the disasters threatened by rising temperatures, or make them far worse.

Because of EDC, Canada is already one of the top fossil fuel financiers in the G20

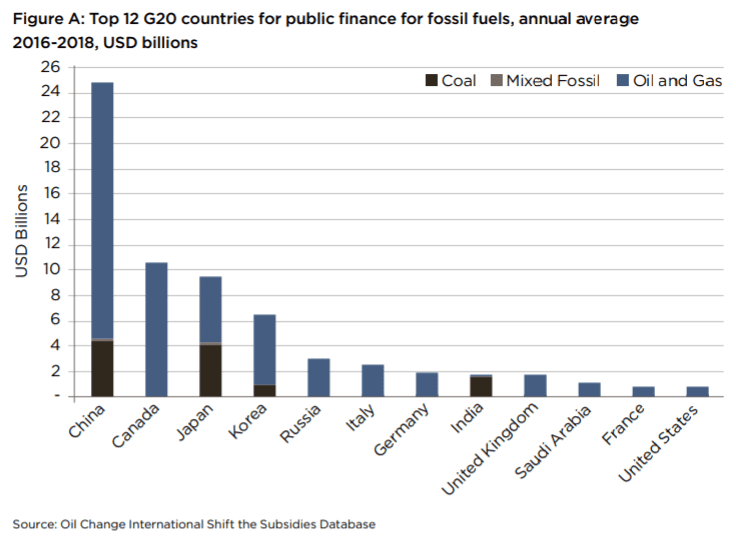

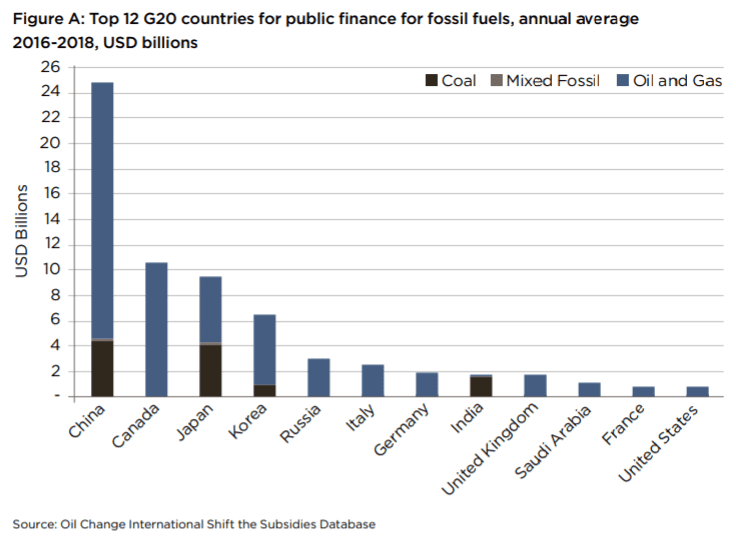

According to a report launched today (Still Digging: G20 Governments Continue to Finance the Climate Crisis), Canada ranks second worst of the G20 countries, and has been providing at least $13.8 billion a year in public finance to the oil and gas sector since the Paris Agreement was signed in 2015.

On a per capita basis, we’re the worst.

The report only looked at financing from Export Development Canada. It didn’t include other forms of subsidies from the federal government, which make Canada’s total support to the industry much higher.

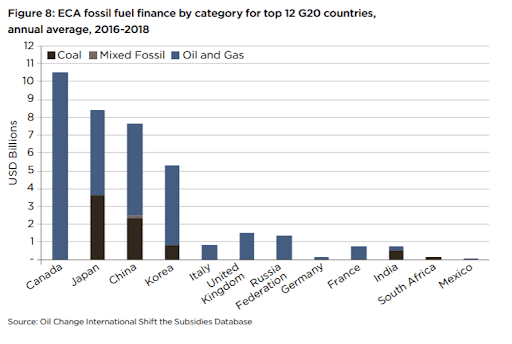

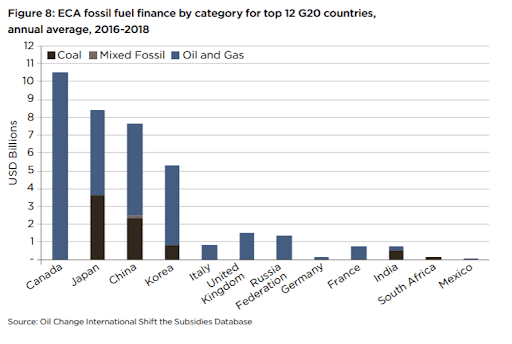

When you compare just export credit agencies’ support for oil and gas, we rank worst. That’s largely because, unusually for an export credit agency, EDC supports projects in Canada. EDC has loaned money to a number of domestic oil and gas projects that violate Indigenous rights and have massive carbon footprints, including the government-owned Trans Mountain Expansion (TMX) pipeline and the Coastal GasLink pipeline.

These aren’t the kinds of records we want to hold. The science is clear. We must cease all government support for fossil fuels if we are to limit warming to 1.5°C and avoid the worst of the climate crisis.

Despite this dismal track record, EDC has been given a major role in COVID-19 response

And all of this is before we get to EDC’s role in the COVID-19 bailout. The federal government has made EDC a key vehicle in its pandemic response through two major financing programs.

The new Business Credit Availability Program will provide loan guarantees of up to $80 million for small and medium companies – with oil and gas listed as a priority sector. Initially the size of this program was capped at $65 billion, but has since been expanded to an unknown amount.

Another (unnamed) multi-billion dollar program was created to provide credit support specifically for the oil and gas sector – up to $100 million per company. There is no maximum price tag for this program.

Before rolling out these programs, the government made changes to the legislation that governs the agency to allow it to take a more active role. These included doubling the cap on the EDC’s total possible liabilities (from $45 billion to $90 billion) and broadening what kinds of domestic activities EDC can support.

These changes make it even easier for the government to use EDC to prop up oil and gas companies.

Export Development Canada has a poor history on transparency – and these new COVID programs follow that pattern

Given EDC’s track record, there is likely going to be a lack of transparency regarding the recipients, amounts and how the assessments of economic viability were made.

Here’s what info hasn’t been made public so far:

We don’t know the total amount of money being made available to oil and gas, but it could be a lot.

When asked, finance minister Bill Morneau said, “we are not putting a limitation” on the oil and gas support program, which will be “demand driven.”

The oil and gas industry has been intensely lobbying the federal government for a liquidity bailout package of up to $30 billion. With no upper limit, this support could reach those levels.

It’s not clear whether conditions will be attached to these loans.

For instance: will companies who receive these funds be required to align with Canada’s target of zero emissions by 2050? Will limits be imposed on share buybacks, dividend payments or executive compensation? Will loan recipients have to abide by strict polluter-pay requirements for inactive wells and tailings ponds clean up? We just don’t know yet.

We don’t know how much risk the agency will take with public money.

There’s no information about how EDC will determine the economic health of companies that could potentially receive bailout support. Many companies in the oil and gas sector were struggling before the COVID-19 pandemic. Guaranteed loans to these companies is a risky proposition that may end up putting taxpayer dollars on the line.

The upshot: given EDC’s history, the public will likely never know the full costs, economic and environmental, of these programs.

We should shift EDC’s finance towards a just transition to clean energy

EDC’s ongoing backing for the expansion of fossil fuels is entirely incompatible with Canada’s climate commitments. It’s also out of step with momentum across the international finance community to shift financial flows away from fossil fuels to clean energy. Many financial institutions, such as the World Bank Group and the European Investment Bank, are already taking steps to stop investing in oil and gas exploration and development.

EDC’s support for clean energy is orders of magnitude smaller than its support for fossils. The government of Canada has an urgent responsibility to shift EDC’s energy financing away from oil and gas to support a global, just recovery to COVID-19 that creates a path to resilient, equitable and zero-carbon societies – instead of further locking in fossil fuel production and use.