Hyewon Kong, M.Sc., CFA is an Associate Portfolio Manager at AGF Investments Inc., providing research and analysis on environmental thematic opportunities. She is part of the team that manages AGF Global Sustainable Growth Equity Fund, one of Canada’s first thematic funds focused on sustainable investments, which does not invest in fossil fuel producers.

It’s not often that investment bankers, portfolio managers, financial advisors and insurance brokers are all in the same room to talk about climate change. But that’s what happened two weeks ago in Toronto.

I was part of a moderated panel discussion called The Business of Climate Change, a conversation about the threats posed by climate change and the economic opportunities offered by the global transformation to a low-carbon economy.

Hosted by Environmental Defence, the event was especially timely, as just days before, several international headlines spoke to the need for re-allocating capital away from fossil fuels and toward low-carbon solutions.

The Volkswagen emissions scandal jolted global markets, highlighting the need for integrity in corporate disclosure of greenhouse gas pollution and signalling a possible shift away from the internal combustion engine and toward electric vehicles. Bank of England Governor and G20 Financial Stability Board Chairman Mark Carney also warned insurance executives that climate change could render the vast majority of fossil fuel reserves stranded. And a report released at a United Nations climate session showed that investors managing US$2.6 trillion in assets will shift their holdings away from fossil fuels.

The week’s events highlighted the growing trend of fossil fuel divestment. What began as a grassroots campaign led by concerned students on university campuses has grown to capture the attention of some of the world’s largest governments, pension funds, financial institutions, and central bankers.

Why are they divesting? Backed by the recent report from the Intergovernmental Panel on Climate Change, governments around the world have agreed to keep the global temperature increase to below 2°C above pre-industrial levels. If temperatures rise above this, scientists say we can expect dire consequences for food and water security, global infrastructure and the health of humans and ecosystems.

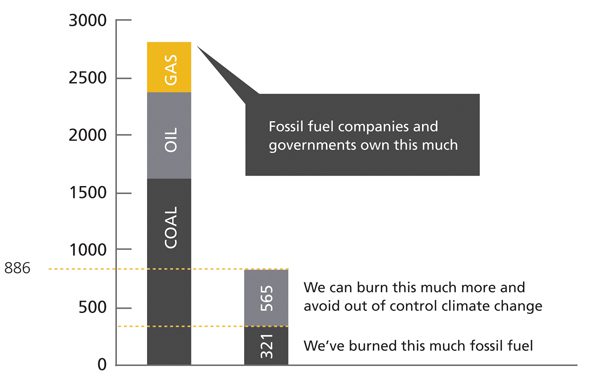

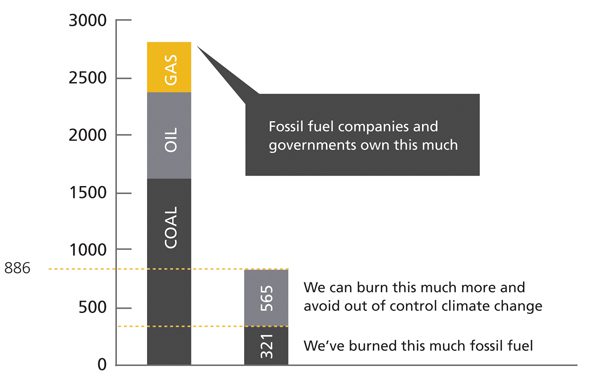

The current global reserves of oil, gas and coal vastly exceed the amount of carbon that can be put into the atmosphere while staying below the 2°C threshold, meaning that about 80 per cent of current reserves must remain in the ground. To avoid dangerous and irreversible climate change, the majority of fossil fuel assets are unburnable, meaning they could be “stranded” in the financial system.

As the world approaches its burnable carbon limit and governments adjust policies accordingly, the remaining fossil fuel assets will suffer from unanticipated write-offs, downward revaluations or be converted to liabilities.

In our view, the growth of the fossil fuel divestment campaign has been encouraging because it has helped focus the investment community’s attention on the risks, and opportunities, of climate change. But divestment alone is not a solution to climate change.

Investors also need to own solutions. By focusing on the long term, tracking multiple environmental objectives and aligning with key sustainability themes, investors can focus on allocating capital to companies that are offering sustainability solutions.

At AGF, our solutions-based approach involves giving investors the opportunity to participate in innovations that are disrupting carbon-intensive industries, such as low-carbon energy and power technologies, waste management and pollution control, waste and waste water solutions, and environmental health and safety.

Investors have a role to play in fighting climate change and building a low-carbon, clean economy. And groups like Environmental Defence, through events like The Business of Climate Change, can help investors break down the silos and connect the dots between the risks of climate change and the opportunities of a low-carbon economy.