Roadmap to a Sustainable Financial System in Canada

Achieving Alignment Through Credible Climate Plans

|

When it comes to Canada’s climate policies, there is a widely overlooked frontier: finance. In this policy briefing, Ecojustice, Shift: Action and Environmental Defence lay out an actionable pathway to address how Canada should regulate climate-alignment within our financial system. The brief shows how financial alignment is a critical piece of the broader climate package needed to achieve Canada’s legally binding climate obligations. |

|

We are in the midst of a worsening global climate emergency. A generation of warnings from the scientific community have failed to provoke the needed collective action and we now face a uniquely challenging crisis. Our inaction has already locked-in significant warming, creating harm and climate disruption now being felt across the globe. This crisis is still accelerating. Without immediate and unprecedented action to stop greenhouse gas (GHG) emissions, primarily by eliminating global dependency on fossil fuels within just a few short decades, the climate emergency will have unthinkable consequences for our economies, our ecosystems, and our society. With growing understanding that further inaction is simply not an option, our governments and institutions are grappling with understanding this crisis and acting with the urgency and ambition required. As part of Canada’s commitment to the Paris Agreement, the government pledged to cut emissions by at least 40-45 per cent below 2005 levels by 2030. This is part of a commitment to achieve net-zero greenhouse gas emissions by the year 2050, which is cemented into Canadian law. In an effort to achieve those goals, the Canadian government has released a series of new policy and regulatory measures designed to cut emissions across a variety of sectors. However, Canada has yet to implement required measures to ensure alignment of these financial flows with these climate goals. Without enforceable rules to address this gap, we will fail to deliver the necessary climate action and risk exposing our financial system to unmanageable levels of risk. Discussion of policy frameworks to put Canada’s financial flows on track for climate alignment have been inconsistent and slow to develop. There is now growing recognition that regulators, institutions, and companies cannot only focus on managing exposure to external climate-related risks if we are to meet our objectives for relative climate safety. Rather, our financial institutions, corporations and their regulators must adopt an approach which considers the impact of financial decisions on society and the planet. This is not just for moral or social good - the risks associated with climate change threaten the financial system to increasing degrees of harm. |

Canada has a global reputation for sound financial regulation. But Canada can only address the climate crisis with robust standards, independent oversight, and rigorous enforcement to align the financial sector with its climate commitments. Decisions made behind closed doors by our banks, asset owners and managers, insurance companies, governments, and corporations shape our society and the path it takes.

The Paris Agreement specifically requires “Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.” This names the need for a global reallocation of capital away from the primary causes of the climate emergency, namely economic activities reliant on fossil fuels, and into proven climate solutions including improving energy efficiency, clean energy development, clean transportation, and sustainable agriculture; activities which increase resiliency to the worsening climate disruption we face. Government climate policy must ensure alignment of these closed-door financial decisions with national climate objectives.

Finance institutions have increasingly adopted a disclosure-based approach to managing climate-related financial risk, based on guidance from the Task Force on Climate-Related Disclosure (TCFD). While this is an essential step in managing climate related risks and ensure high quality information, it is inadequate to appropriately manage these risks or align the financial system with climate commitments. New voluntary coalitions of global financial institutions have formed to move beyond disclosures and promote climate- alignment under the umbrella of the Glasgow Financial Alliance for Net Zero (GFANZ).

These voluntary initiatives prove that science-based climate alignment is realistic and achievable for the finance sector. But their inconsistent participation and lack of enforcement reveal the need to enshrine these standards through regulation. The UN-backed Race to Zero campaign which oversees GFANZ states: “voluntary action has had an enormous impact, but it is not enough to achieve the goals of the Paris Agreement.” We must move to “clear ground rules” for a climate-aligned economy. Regulation of the financial sector is clearly required to align pathways with required climate action, set credible standards, restore public trust, and ensure a fair and level playing field across financial institutions.

The federal government has already made public commitments to align Canada’s financial flows with its climate commitments, including phasing out public subsidies for fossil fuels by Crown corporations and requiring federally regulated financial institutions, pension funds and government agencies to issue net-zero plans. This Roadmap proposes a package of the regulations that the federal government can introduce to deliver on these promises.

The recommendations made in this briefing focus on achievable federal measures, but several key aspects of the financial system in Canada are within provincial authority. The key principles and recommendations in this Roadmap should inform the development of climate-aligned financial flow at the provincial level as well. The Roadmap’s cornerstone recommendation is to require the adoption of a Credible Climate Plan by financial institutions, federal entities and corporations. The Credible Climate Plan would formalize, standardize, and extend commitments that many Canadian financial institutions have already made under voluntary initiatives like GFANZ.

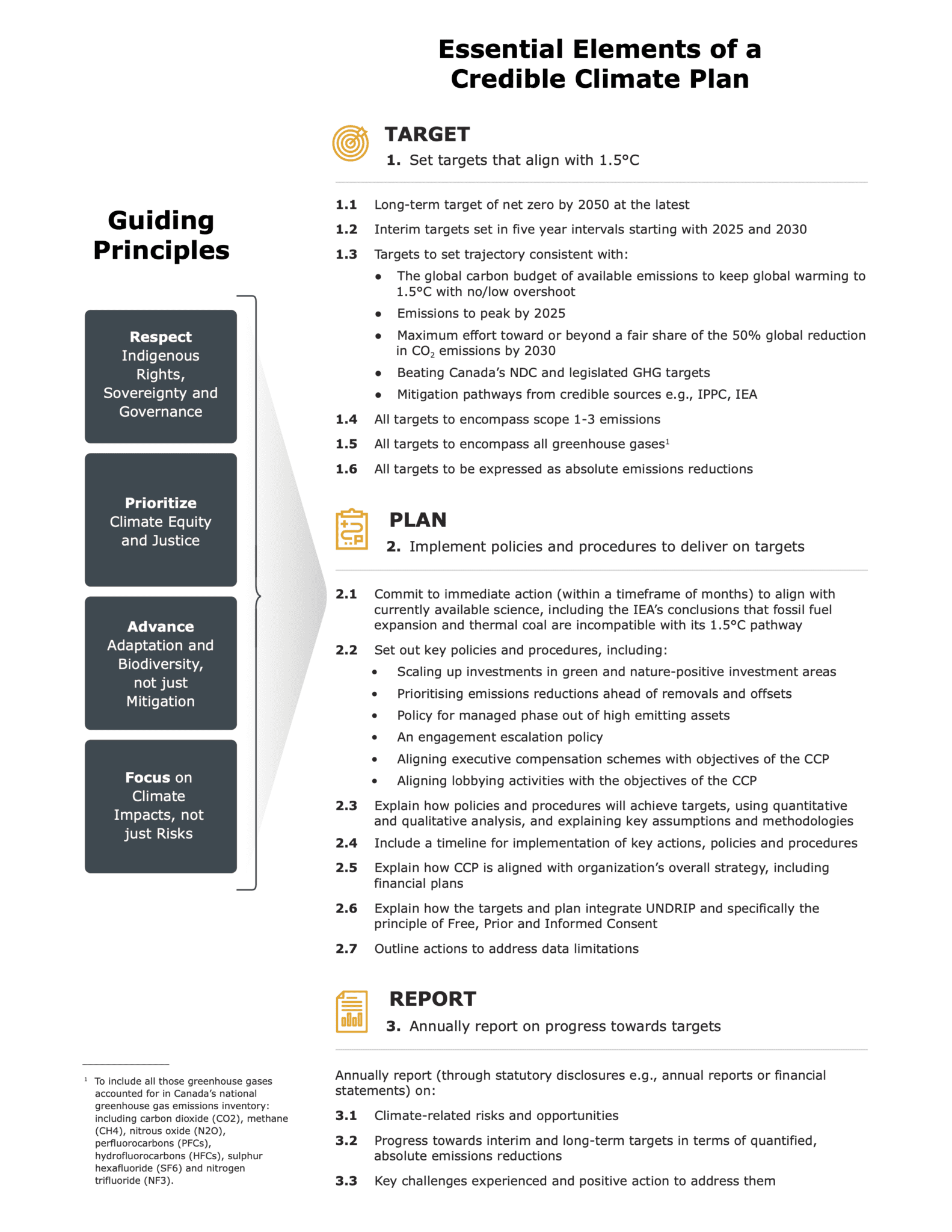

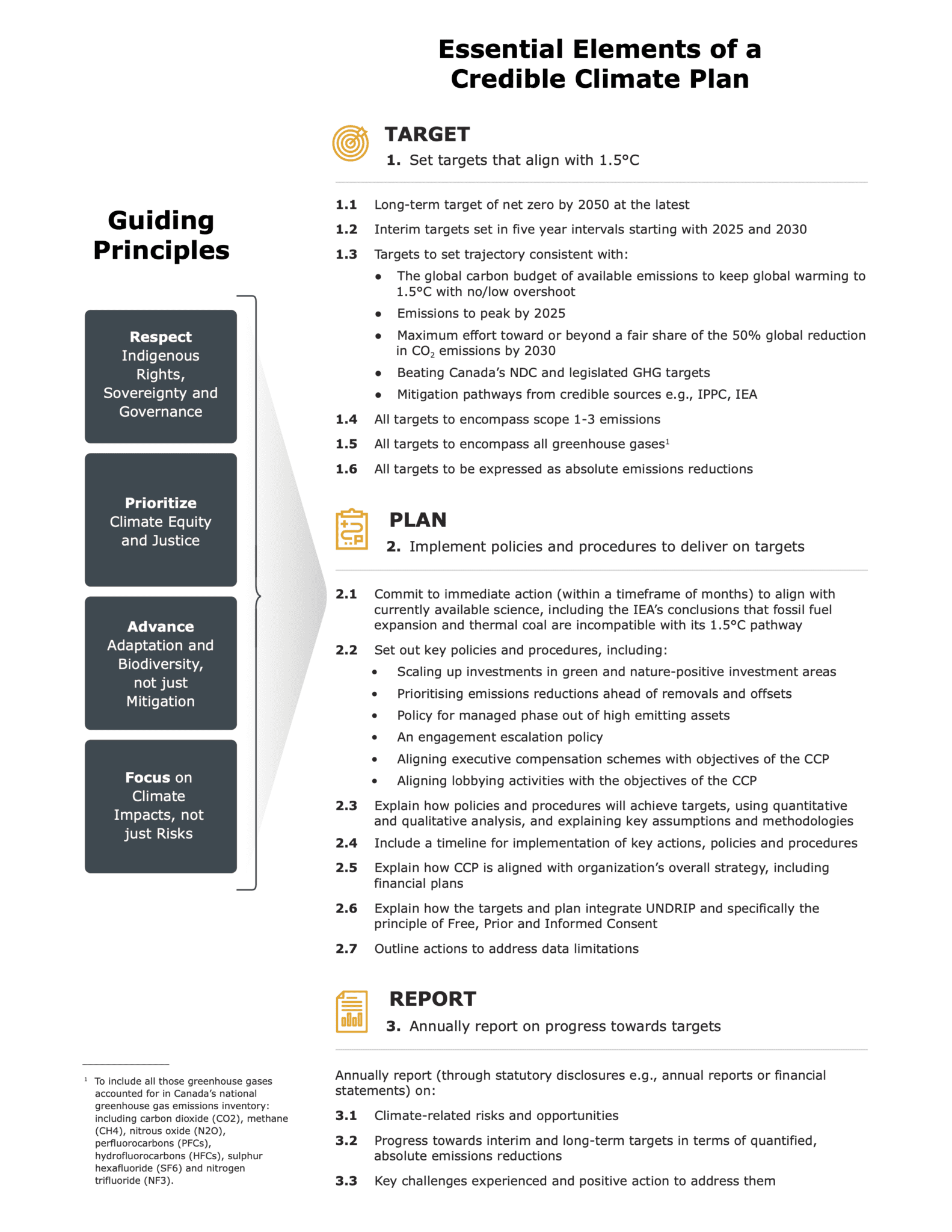

A Credible Climate Plan rests on three pillars. First, institutions must adopt five-year targets to align with keeping warming below 1.5°C, starting from 2025. These targets must be science-based and include all scope one, two and three of emissions. Institutions must then publish plans to deliver these targets, including policies to phase out high-emitting assets, scale up green investments, and align lobbying activities. Institutions would be required to annually report to regulators on their progress against their emission reduction targets. The Credible Climate Plan should ensure respect for Indigenous rights, and alignment with equity, justice, and proactive adaptation. Climate-related risk disclosure should be mandated across the economy as part of a Credible Climate Plan but is not sufficient in itself.

Most of the recommendations in this Roadmap can be implemented relatively quickly through a combination of regulations, guidance, and directions made under existing legislation. In view of the need to rapidly shift financial flows towards alignment with Canada’s climate goals, this should be favoured wherever possible. However, legislative change is required in the longer-term, both to ensure that reforms are durable and subject to proper legislative scrutiny, and to implement those recommendations that are not currently possible through regulation.

Canada has a closing window to limit the worst impacts of a warming world. Policy action is needed now from our governments to protect both the stability and health of our financial system as well as our shared climate. It is time to extend Canada’s world-class reputation for effective and prudent financial regulation through these practical and achievable measures.

|

The foundational recommendation of this Roadmap is for financial institutions (both public and private) as well as large corporations, to be required to prepare, publish, and implement a “Credible Climate Plan”: a plan that contains minimum prescribed “essential elements” to ensure that it is aligned with climate goals. The purpose of these plans is to move beyond disclosure, towards action that aligns with climate goals. |

|

Mandatory Credible Climate Plans for private financial institutions, federal public bodies, and large private corporations are necessary as voluntary commitments and initiatives have not led to action at the pace and strength needed. The standards for climate action in Canada are unclear. Many institutions have a lack of expertise, knowledge, and motivation to drive climate action where competing priorities take precedence over climate action. Mandating Credible Climate Plans for public and private financial institutions, pension plans and large corporations will begin to align financial flows with Canada’s climate commitments and a 1.5°C pathway. Credible Climate Plans will assist these organizations by establishing clear standards, common criteria and providing a shield against legal or other challenges to the credibility of their climate commitments. Although individual institutions are best placed to determine what specific action to take to align their business with 1.5°C, plans must be based on standardized, uniform minimum standards to ensure transparency, comparability, and accountability. Credible Climate Plans should be reviewed and/or approved by the relevant regulator, and regularly reported on through integration into existing reporting frameworks such as annual financial statements. Regulators must be required to review Credible Climate Plans within a certain timeframe, and either approve or request amendments if they do not meet minimum requirements. Regulators must publish Credible Climate Plans and the results of their review on an easily accessible website to promote transparency. The requirement to adopt a Credible Climate Plan containing these essential elements should be required by regulation, while the key principles should be advanced through accompanying guidance. |

ACKNOWLEDGEMENTS: Produced by ENVIRONMENTAL DEFENCE, Ecojustice and Shift: Action. Researched and written by Alan Andrews, Andhra Azevedo & Tanya Jemec of Ecojustice, Julie Segal of Environmental Defence, and Adam Scott of Shift: Action. For a full list of contributors please download the report.

© Copyright March 2022 by ENVIRONMENTAL DEFENCE CANADA. Permission is granted to the public to reproduce or disseminate this report, in part, or in whole, free of charge, in any format or medium without requiring specific permission. Any errors or omissions are the responsibility of ENVIRONMENTAL DEFENCE CANADA.