In the first blog, we showed that future oil and gas investments are on track to become major stranded assets. In the second blog, we revealed the collapse in government revenues and jobs in the oil and gas sector, especially in provinces that rely on oil and gas royalties.

Now, in the final blog of the series, we focus on where to go from here. Because there’s a smarter, more stable and more profitable economic path ahead – and it doesn’t run through another oilfield. It’s time to move on from fossil fuels. Not just to meet our climate goals, but to unlock the next wave of investments, innovation and national prosperity.

New analysis by Environmental Defence and International Institute for Sustainable Development shows that halting the development of new oil and gas fields actually increases the value of the sector. Under a 1.5°C scenario, Canada’s oil and gas industry swings from a USD $43 billion (CAD $59 billion) liability to a USD $38 billion (CAD $52 billion) asset if no new fields are developed.

And if Canada supports international diplomacy to limit global fossil fuel expansion? Well, the value climbs up again – up to USD $43 billion (CAD $59 billion) in net gains. That’s not just environmental logic – it’s basic economics.

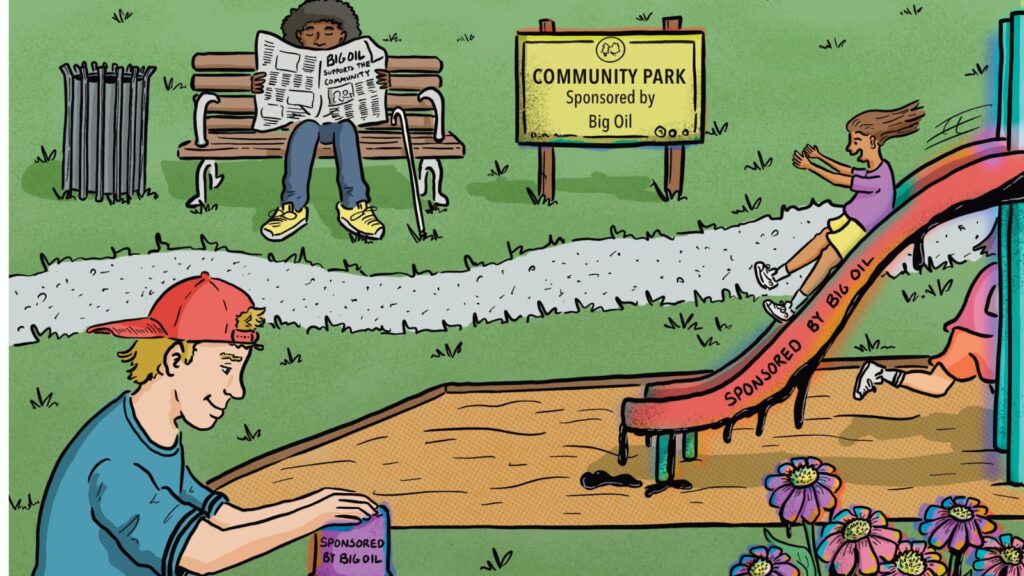

Approving more oil and gas projects in a shrinking global market isn’t smart – it’s reckless. It reduces returns on investment, diminishes government revenues, locks us out of better opportunities and exacerbates the climate crisis.

Canada has the chance right now to be on the winning side of the energy transition. While fossil fuels face rising costs, shrinking markets and growing political risks, renewables continue to soar.

Wind and solar are by far the cheapest forms of energy in the world. Investments in clean electricity, smart grids, heat pumps, public transit and green infrastructure are attracting trillions in global capital. In fact, in 2025, investments in clean energy technology are set to double investments in fossil fuels. The countries that make smart investments in clean energy will lead the next phase of economic growth.

Canada could be part of it, but only if we stop propping up the past.

Phasing out fossil fuels isn’t about shutting things down overnight. It’s about managing risk and prioritizing smarter investments. It’s about developing policies, infrastructure and energy systems that can successfully replace fossil fuels – not just in terms of energy supply but also in economic value and stability. Most importantly, it means ensuring that affected communities aren’t left behind but are supported with concrete transition plans, financial tools, and a real stake in building what comes next.

This is nothing new. In 2018, Alberta imposed a cap on oil production – not for climate reasons but to stabilize prices during a market crash, showing that when the economic pressure is strong enough, governments act. This time, the pressure is global, structural and irreversible. The longer we wait to implement a transition away from fossil fuels, the more costly and disruptive it will become.

The world is moving on. Canada can either benefit by being part of the global energy transition or fall behind. The choice isn’t between climate action and economic growth. The choice is between a chaotic economic collapse and a planned, prosperous transition.

Canada must stop approving new fossil fuel projects in order to protect the value of oil and gas that is already in production. At the same time, the federal and provincial governments in Canada must plan for a managed phaseout of all fossil fuel production domestically, while championing phaseout internationally as well. The benefits of a fossil fuel phaseout aren’t just limited to environmental benefits; they are economic too.